|

28 September 2017

Posted in

Special research

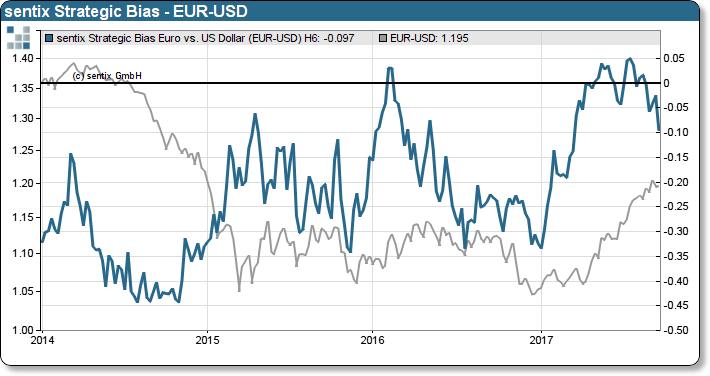

Since the beginning of the year, the euro has been one of the stars in the foreign exchange market. Approximately 12% has the Euro gained in value against the US dollar. But now a trend reversal is emerging which could catch investors on the wrong foot. This is shown by the sentix Strategic Bias, which is at a turning point.

The euro surprised most investors this year. At the beginning of the year there was the expectation that Trumps policy agenda would lead to an appreciation of the US dollar. Correspondingly, investors were positioned long US dollars. That went wrong. Well, in September 2017, the situation has changed. The euro has gained strongly and the investors are mainly positioned long in euros. And this to a considerable extent. This could turn out to be a mistake.

sentix Strategic Bias EUR-USD and EUR-USD prices

In the meantime, the strategic bias, that is, the investor's basic trust, has turned. This is usually accompanied by a reduc-tion of positions held by investors. The cause for this mood change is likely to be a variety of factors. On the one hand, the FED is becoming increasingly restrictive and puts the interest markets under pressure. On the other hand, Trump now seems to be moving forward about tax cuts. But a German factor should also be important: the weakness of Merkel after the election, the difficulties of a new coalition and plans of French president Macron should not strengthen the confi-dence in the euro. In the past, a Bundestag election often represented a caesura in EUR-USD. This is likely to be the case again in 2017.